2 days ago EP0 The importance of goalbased investing The Money Show 25 OCTOBER 21 ET NOW 23 MIN 12 SEC Amol Joshi, the Founder of PlanRupee Investment Services spoke exclusively with Alex Matthew of ET NOW on the importance of setting financial goals for investors During the conversation, it was highlighted that investing without a goal isPost category I Goal Based Investing;Goalbased investing is all about identifying your financial goals, setting a timeline for each one of them, and investing for them regularly to be able to reach them So essentially, you give all your dreams and financial goals a structure

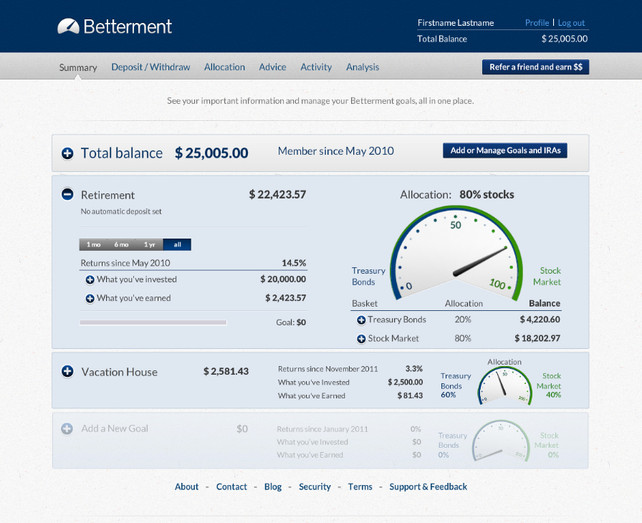

Using Investment Goals At Betterment Goal Based Investing Advice

Vanguard goal based investing

Vanguard goal based investing-Post comments 0 Comments Goal based investing is based on the premise that financial planning is more effective when you work towards achieving a goal rather than chasing returns A goal based investment strategy first creates a personalised financial goal according to the investor's age, income, expenses, savings and risk appetite

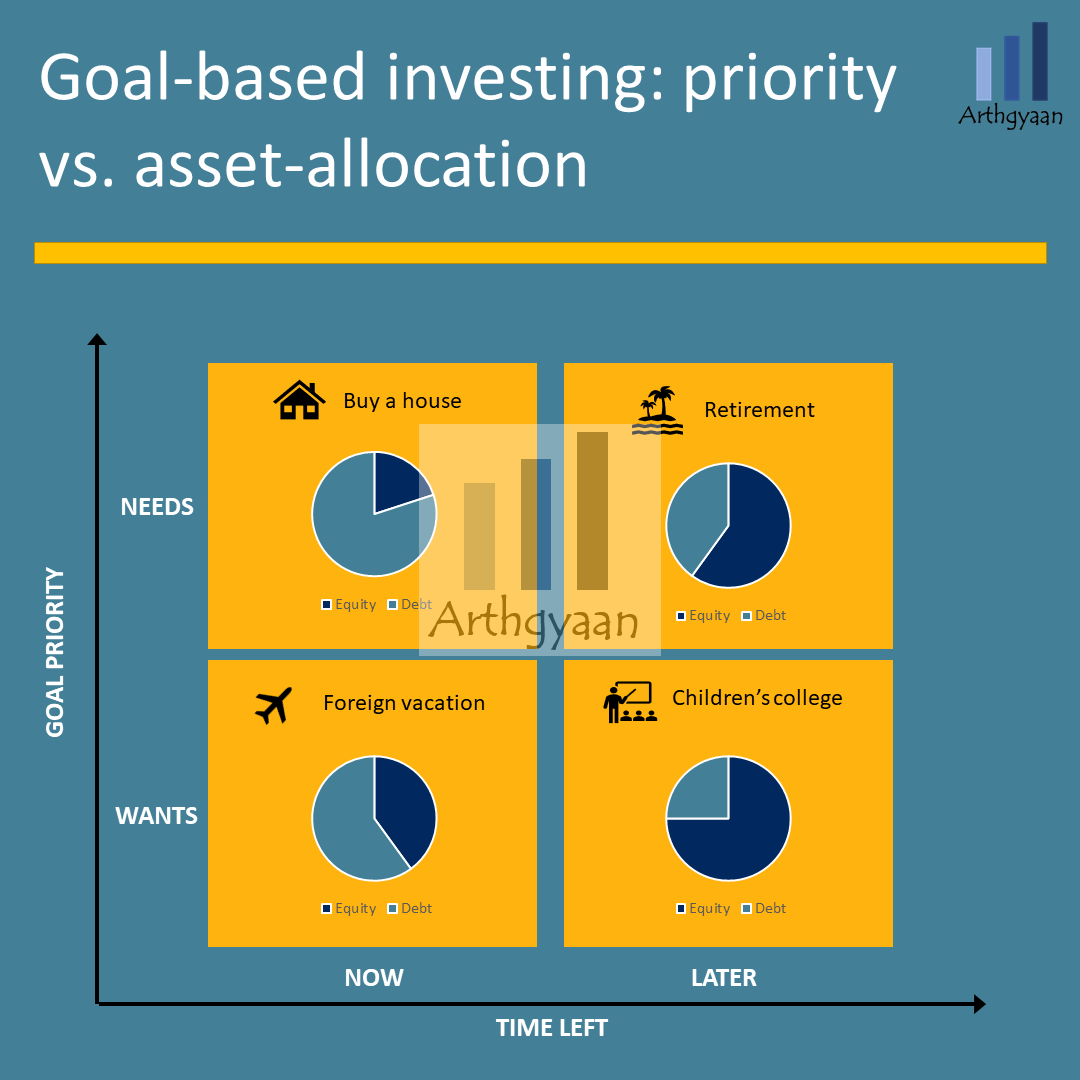

How Goal Based Investing Helps You To Cut Through The Clutter And Lets You Get Started With Investing Arthgyaan

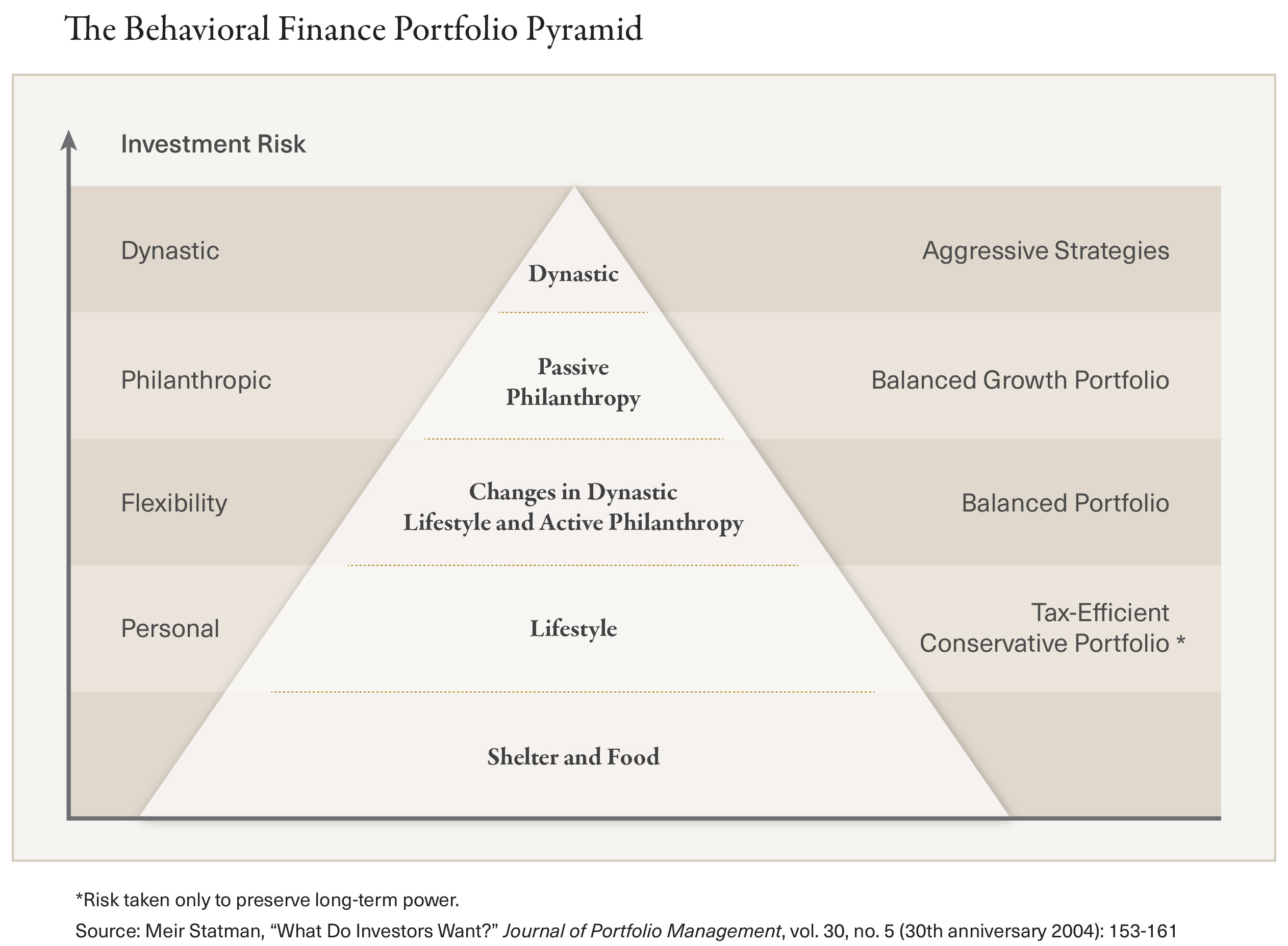

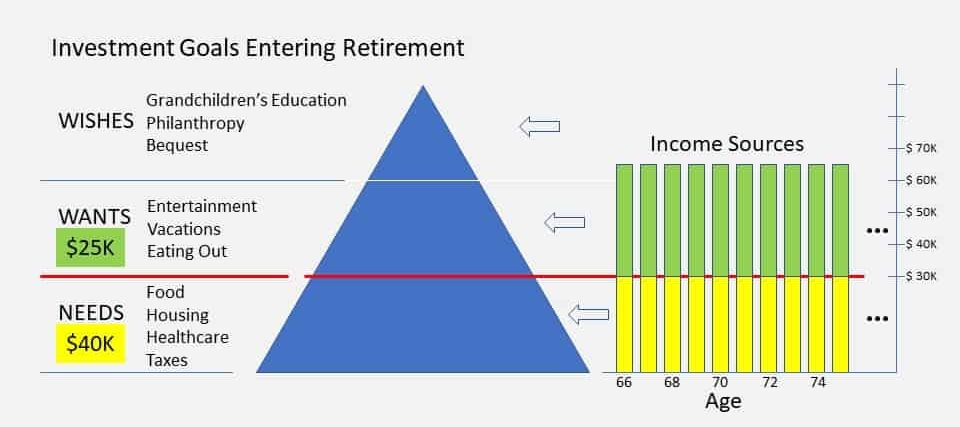

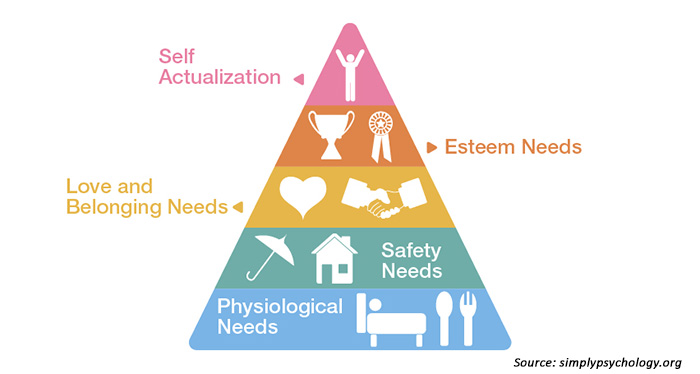

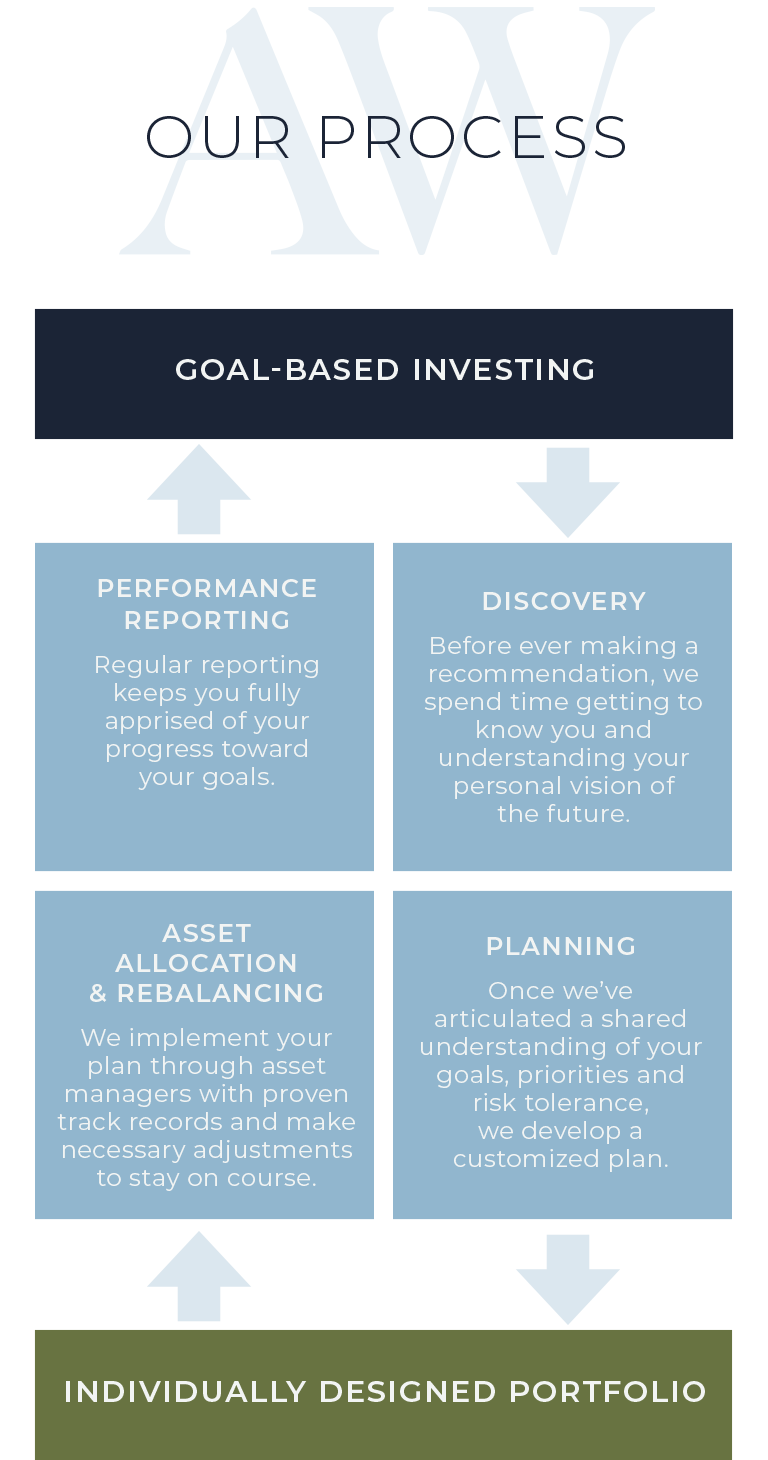

Gaining clarity about your intentions and commitments is the first step to living the life you want The unique approach Goldman Sachs Personal Financial Management takes to goalbased investing focuses on the importance of you and your financial advisor understanding the Goalsbased investment theory not only acknowledges these goals, it provides budgets and portfolios for them In the end, goalsbased investing is simply about using financial markets to achieve your goals under realworld constraints But that can only happen by first understanding and modeling the objectives you're actually trying to achieveGoalsBased Investing or GoalDriven Investing (sometimes abbreviated GBI) is the use of financial markets to fund goals within a specified period of time Traditional portfolio construction balances expected portfolio variance with return and uses a risk aversion metric to select the optimal mix of investments By contrast, GBI optimizes an investment mix to minimize the probability of failing

Goalbased investing The idea is prized among financial advisors—and our team at Betterment—but to the everyday investor, it's often difficult to put into practice After all, being clear about the purpose of one's savings can be a challenge Goalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and introduces a general operational framework that can be used by financial advisors to help individual investors optimally allocate their wealth by identifying performanceseeking assets Simply log in and select my portfolio Then choose from goalbased investing or general investing Then select the fund you wish to sell and click withdraw Please note once you click withdraw, the full investment amount held in that particular fund will be sold You can't sell part of your investment

Goalbased investing vs traditional investments What's the difference between the two and does a more personalized approach yield more returns in the long run? Goal based financial planning is simply a structured approach to goal based investing that can ensure a much higher chance of success in meeting your financial goals It is always recommended to engage a financial planner or advisor , if you think you need helpArchive for the 'Goal based investing' Category Navigating volatile markets – Are you armed with a personal financial plan?

What Is Goal Based Investing Baraka

Understanding How To Apply Goal Based Investing Practically Motilal Oswal

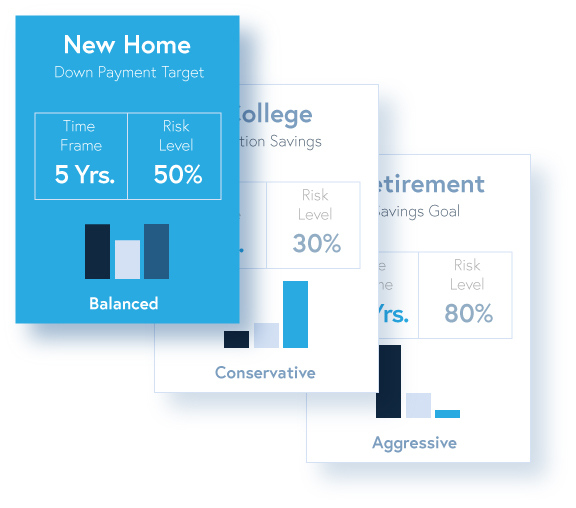

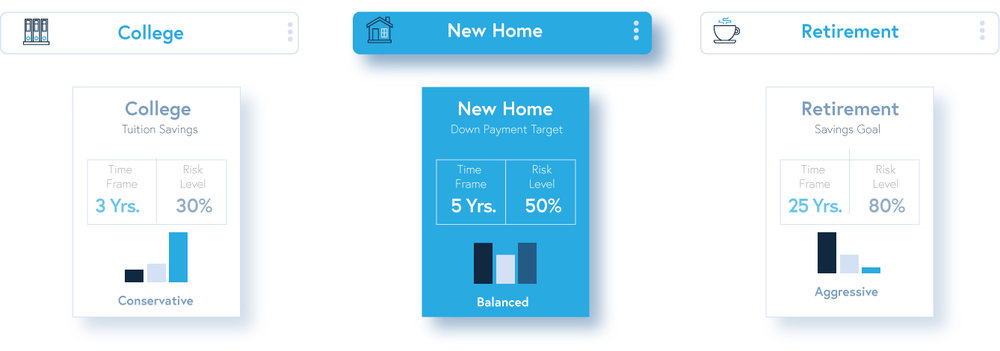

Goalsbased investing is an approach which aims to help people meet their personal and lifestyle goals, whatever they may be, in a straightforward and simple way It does this by placing people's goals right at the centre of the advice process and aims toSIP for Goal Based Investing SIP can be your ideal partner in this journey of meeting financial goals as it is an adaptable investment facility SIP ensures effective planning as you can invest an amount for each goal regularly from your savings As SIPs can be separated for each goal, it ensures clarity of how much you have achieved so you do From there, we create a customized investment portfolio for each of the goals you're investing toward And each portfolio can differ from the others, based on the type of goal you want to achieve For example, a retirement savings portfolio will be very different from a more nearterm Big Splurge goal

My Goals Are Beyond Your Understanding

Goal Based Investing Alpha Wealth Advisors Llc

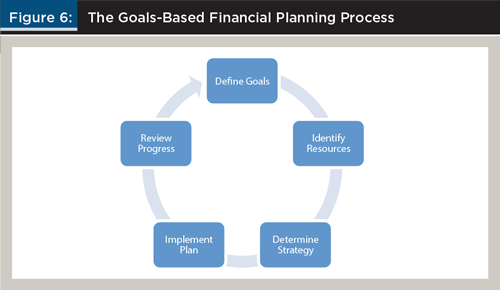

Horizon Investments offers an innovative goalsbased investing program with corresponding model portfolios, platform tools, mutual funds, and ETFsOur Gain Protect Spend® framework is designed to optimize financial planning as investment goals and risks change throughout your client's life or investment journeyIt is therefore sensible to plan, save, and invest for those future financial goals in advance by putting away some of your current income Goalbased investing is an approach that aims to help you come up with a plan to save and invest current earnings smartly to accomplish a The goalbased investing planning process comprises 5 phases #1 Define possible financial objectives #2 Identify current and future available resources #3 Determine the appropriate strategy for the distribution of capital between savings and investments, in accordance with their characteristics and personal conditions, and aimed at achieving objectives #4 Implement the plan

Learn More About Goal Based Investing Today Iinvest Solutions

Where There S A Goal There S A Way Goal Based Investing

Goal based investing is a relatively new concept in wealth management wherein the emphasis is on investing with the objective of attaining specific life goals It involves measuring one's progress towards these specific financial goals, such as savings for children's education, buying a house, or building a What Is Goal Based Investing?Goalbased investing (GBI) implements dedicated investment solutions to generate the highest possible probability of achieving investors' goals, with a reasonably low expected shortfall in case of adverse market conditions Related Content Publications

Goal Based Investing A Structured Approach

You Can Be Rich Too With Goal Based Investing By P V Subramanyam

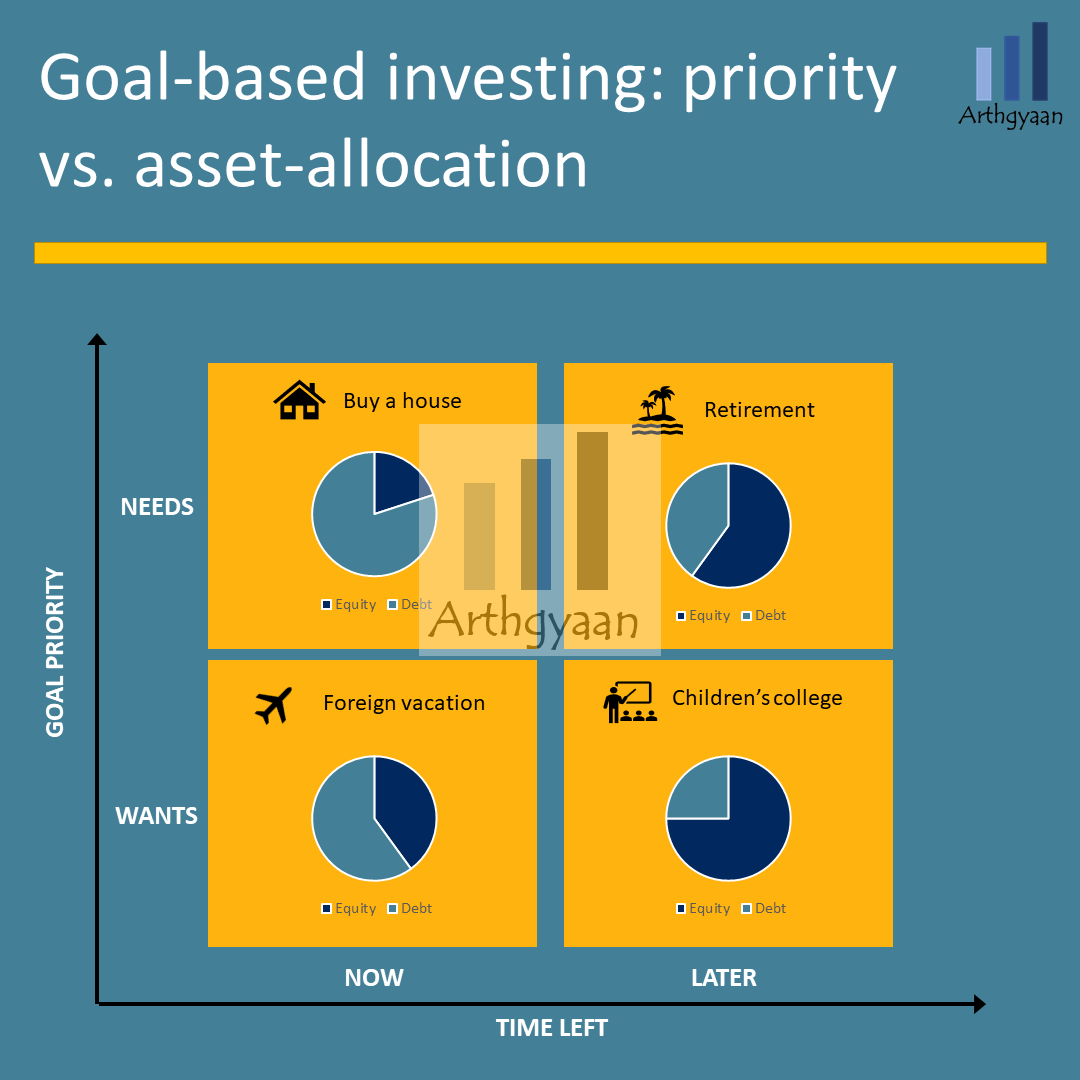

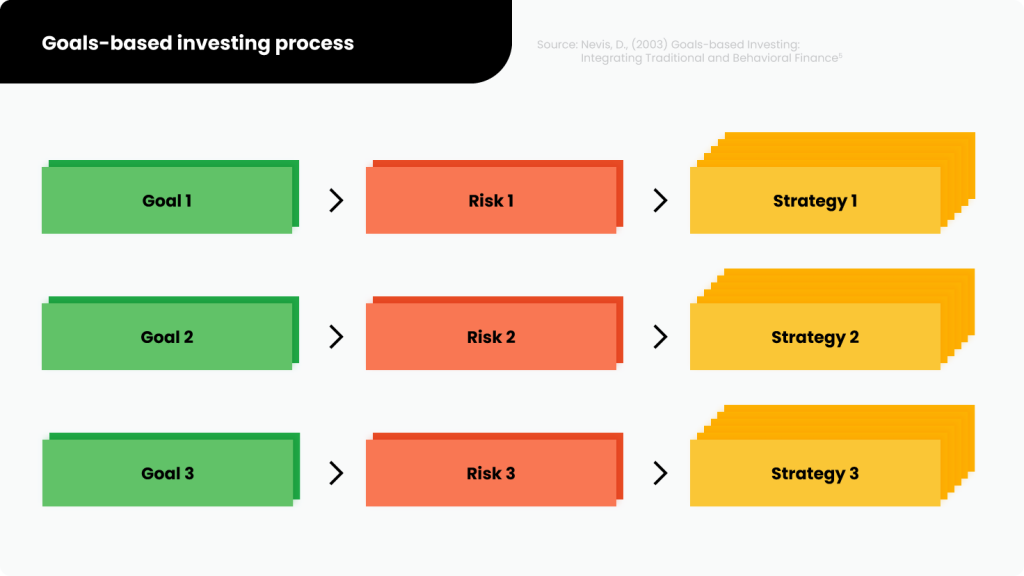

GoalBased Investors Blog A resource with ideas, tools and practical ways to build a better financial life PlanningGoalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and introduces a general operational framework that can be used by financial advisors to help individual investors optimally allocate their wealth by identifyingGoalbased investing examines your goals and assigns each a separate investment strategy relative to the goal's importance, time horizon and level of risk with which you are comfortable PERFORMANCE is measured as progress toward achieving each goal, rather than returns compared to an arbitrary benchmark

I Have Heard Of Goal Based Investing What Now Arthgyaan

1

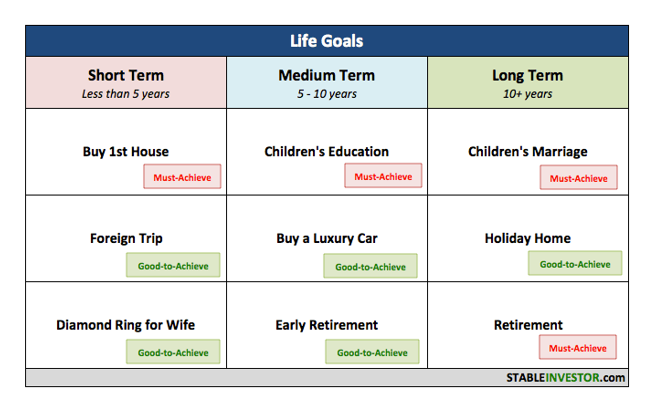

Investing regularly to be able to reach the respective financial goal is called goalbased investing For example, if you plan to buy a car in next 23 yeas, it can be called a shortterm goal Likewise, if you wish to plan for your retirement and children's higher education, then these can be termed as long term goals Goalsbased investing may seem like an obvious concept, but it represents a departure from the typical risktolerance framework, which profiles clients based on whether they have a conservative Investing in a systematic manner is one way to achieve these goals Giving your investments a target to achieve, on the other hand, helps you appreciate the importance of your investment Goalbased investing is a method of making investments after determining what you want to do in the future

Invest With Goals In Mind

Goal Based Investing Ppt Powerpoint Presentation Outline Outfit Cpb Powerpoint Slide Presentation Sample Slide Ppt Template Presentation

Goalsbased investing is a framework to translate financial goals into forecast future expenditures and allocate money to separate portfolios designed to meet those specific goals The process ofGoalbased investing is a process that makes your investments after setting up goals on what you want to achieve in the future Mapping out all your needs gives you a clearer picture and the time for which you need to stay invested to achieve each goal Goalbased investing is an investment approach that considers one's end financial goal, hence helping the investor make investments that complement the end goal By linking the investments to a goal, the aim of this approach is to systemize savings over a specific duration to yield expected results In this article we would detail about Goal Based Investment approach

Financial Success Using Goal Based Investment Key To Success

I Am Now Ready To Do Goal Based Investing What Now Arthgyaan

As the name suggests, goalbased investing is planning and making investments to achieve specific life goals With a robust financial plan in place, your goals will be realized for sure This concept may sound novel, but goalbased investing has been around for a while An example of goalbased investing can even be derived from Kanchivaram aGoalsbased investing empowers intermediaries, institutions and individuals alike to focus on what really matters achieving goals And when you marry those goals with our global economic perspective, it's a powerful framework that Improves on traditional portfolio construction, as it places a larger emphasis on alignment with investor goals With goalbased investing, each of your investments has its own unique purpose to help you achieve a specific financial goal You can use goalbased investing to align your investments with your life goals while determining how to make the most beneficial tax moves Goalbased investing forces you to sit down and prioritize what matters to you most, which is

Xeno Investment A Dream Is Just A Dream A Goal Is A Dream With A Plan And A Deadline Come Learn About Goal Based Investing With Xeno It Will Change Your

Investment Management Integrated Wealth Management Financial Planner Investment Management Seattle

Drive outcomes across the wealth curve Horizon's purposebuilt, academicallyrigorous goalsbased investment products are designed to optimize portfolios as investor goals and risks evolve during the investment journey Introducing Horizon's unique goalsbased approach We call it GAIN PROTECT SPEND® Here is a stepbystep to guide, plus calculator, to begin and track longterm goal based investing Most goal planning calculators tell you how much you should invest This sheets asks you, how much you can invest and goes about calculating the portfolio return With that you can calculate the asset allocation required (equity to fixed income ratio)Goalbased investing vs traditional investments What's the difference between the two and does a more personalized approach yield more returns in the long

Goal Based Investing Investing Mutuals Funds Market Risk

Smart Investing Asset Allocation In The Time Of Coronavirus Crisis The Financial Express

Goalbased investing is an investment strategy that is more precise, greater detailed, and attaches something personal and important to you It simply forces us to think about what matters most in our lives Each account has its own unique plan to accomplish a particular goal by a certain date, with its own unique portfolio allocation and Goalbased investing is more than just a form of mental accounting that assigns labels like "house," "college" or "retirement" to different pots of money A switch to goalbased investing, for instance, changes the way advisors assess their clients' risk capacity Instead of asking new clients how far they could stand to watch thePosted in Financial Planning, Goal based investing,

Practicing Goal Based Funding Is A Should India Dictionary

Goal Based Investing The Planning Process In Practice Investorpolis

GoalBased Investing is the modern and correct way to personal wealth management and investing Post author Feria; Goalbased investing is the best way for most people to save and invest for the longterm In the old days, stock brokers would ask you how much risk you could tolerate It turns out, most people don't know how to answer that questionGoalBased Investing Research is conducted by experienced wealth managers and investment firm's clients It involves checking the progress of the GoalBased Investing strategy and how much it has supported in achieving the specific life goals Goalbased investing is better because it is a SMART (specific, measurable, attainable, relevant

My Goals

Goal Based Investing And Application To The Retirement Problem Edhec Risk Institute

1 day ago The concept of "goalbased marketing" is easy to understand The strategy links the sale of crops or livestock to a goal for your business

Goal Based Reporting Tools For Investment Advisory Firms

Goals Based Investing An Approach That Puts Investors First

What Is Goal Based Financial Planning Anyway Stable Investor

Goal Based Investing Through Mutual Funds Mymoneysage Blog

A Framework For Goals Based Investing Boston Private

Goal Based Investing Innovative Use Of Established Methods 3rd Eyes Analytics

Goal Based Investing Platform Fountain Raises First Seed Round Startacus

The Value Of Setting Investment Goals Mintos Blog

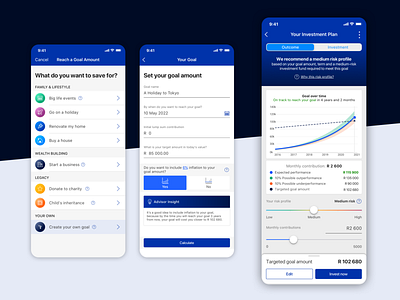

Goal Based Investing Designs Themes Templates And Downloadable Graphic Elements On Dribbble

I Am Now Ready To Do Goal Based Investing What Now Arthgyaan

Use Private Equity Real Estate To Meet Personal Investment Goals

Goals Based Investing Private Wealth Partners

Principle 8 Match Your Strategy To Your Goals Washington Crossing Advisors

Goal Based Investing How Does It Work Everyfin Newsletter

Goal Based Investment Planning

Betterment Review Get Motivated With Betterment S Goal Based Investing The Humble Broker

Using Investment Goals At Betterment Goal Based Investing Advice

Goal Based Investing Is The Modern And Correct Way To Personal Wealth Management And Investing Investorpolis

Learn More About Goal Based Investing Today Iinvest Solutions

Why Goal Based Investing Is The Key To Gain Returns Sheroes

Goal Based Investments Service Investment Service Bm Fiscal Point Advisors Pvt Ltd Pune Id

The Power Of Goal Based Investing First Republic Bank

Why Practicing Goal Based Investing Is Essential For Small Investors

Why Practicing Goal Based Investing Is Essential For Small Investors

Plan Your Financial Life With Purpose The Importance Of Goal Based Investing

Goal Based Investing Blog Central Investment Advisors

Goals Based Investing For Affluent Families And Individuals Sei

How Goal Based Investing Helps You To Cut Through The Clutter And Lets You Get Started With Investing Arthgyaan

The Power Of Goal Based Investing First Republic Bank

Goals Based Investing Horizon Investments

_1616062655053_1616062665121.jpg)

The Importance Of Goal Based Investing For Wealth Creation Hindustan Times

1

Goals Based Investing The Cnr Way A Fresh Take On An Established Approach

Why Practicing Goal Based Investing Is Essential For Small Investors

What Is Goal Based Investing Baraka

Your Money Why Volatility Is A Friend In Goal Based Investing The Financial Express

Goal Based Investment Planning Retirement Planning Example And Video

Why Practicing Goal Based Investing Is Essential For Small Investors

What Is Goal Based Investing Why It Is Important For You Kuberverse

Goal Based Investing Plan Ahead Simplifying Your Financial Life

Goal Based Investing Gbi Edhec Risk Institute

Goal Based Investing Process Investment Benefits Wiseradvisor Infographic

Goal Based Investing 4 Important Reasons Why It Is Important Abc Of Money

Diy Stock Investing Vs Goal Based Investing Tbng Capital

Eton Advisors Wealth Management

Amazon Com Goal Based Investing Theory And Practice Romain Deguest Lionel Martellini Vincent Milhau Books

Why Should You Opt For Goal Based Investment Planning Bestinvestindia Personal Financial Blog

Three Pillars Of Goal Based Investing First Rate

Goal Based Investing How Does It Work Everyfin Newsletter

Goal Based Investing Savings Buckets Betterment

How To Optimize A Goal Based Portfolio Franklin J Parker Cfa

Going Deeper With Goals Based Investing Amg Funds

Goal Based Investing Through Mutual Funds Mymoneysage Blog

Money Musingz Personal Finance Blog Goal Based Financial Investing

Eton Advisors Wealth Management

Goal Based Investments Financial Planning Guide Advisors

Goals Based Investing An Approach That Puts Investors First

V10 I07 Chart Upclose 1 700px V1 Proactive Advisor Magazine

What Is Goal Based Investing Upwealth Youtube

Fintech Innovation From Robo Advisors To Goal Based Investing And Gamification Wiley

Goals Based Investing Suggested As Replacement To Advisers Traditional Approach Ardent Wealth

Goal Based Investing A Structured Approach

Rankmf Baskets The Best Approach To Goal Based Investing

:max_bytes(150000):strip_icc()/Bettermentvs.Wealthfront-5c61bcf246e0fb0001dcd5c2.png)

Goal Based Investing Definition

Why Practicing Goal Based Investing Is Essential For Small Investors

Flat Fee Investment Portfolios Derive Wealth

Where There S A Goal There S A Way Goal Based Investing

What Is Goal Based Financial Planning Peak Financial Services

:max_bytes(150000):strip_icc()/ellevest-vs-betterment-ebf2bcde1eec4958969a2d2171f2687c.png)

Goal Based Investing Definition

Goal Based Investing Wikipedia

Richvik Wealth Advisory Private Limited However Giving The Investments A Goal To Achieve Makes You Better Understand The Value Of Your Investment Goal Based Investing Is A Process That Makes Your Investments

Goals Based Investing Should It Be The Norm Cfa Institute Enterprising Investor

Are You Investing Towards Your Goals Boston Private

Goal Based Investing Quantifeed

Where There S A Goal There S A Way Goal Based Investing

Goal Based Investing Through Mutual Funds Youtube

Goal Based Investing Alpha Wealth Advisors Llc

:max_bytes(150000):strip_icc()/wealthfront-vs-td-ameritrade-essential-portfolios-072e85eb93f449cab08317a9625d8776.jpg)

Goal Based Investing Definition

Standard Bank Save Invest Robo Advisor By Marli Terblanche On Dribbble

Learn More About Goal Based Investing Today Iinvest Solutions

Goals Based Investing Integrating Traditional And Behavioral Finance Jakub Karnowski Cfa Portfolio Management For Financial Advisers Ppt Download

Goal Based Investing Planning For Key Life Events 19 Financial Poise

0 件のコメント:

コメントを投稿